You Think Greece is Bad - Take a Look at China

Published on July 8, 2015

Published on Wealthy Affiliate — a platform for building real online businesses with modern training and AI.

The Coming Chinese Wrecking Ball

"Feeling panic in the air, stock market officials called on one of their own to turn the tide. They gave him a pocket full of cash and a directive, buy until stocks trade higher. He dutifully stepped onto the floor and began purchasing blocks of blue chip companies at above-market prices. Market participants quickly fell in line, buying up shares and pushing up prices".

This is not a recap of events in China. This is what actually happened in the U.S. in early October, 1929.

As losses mounted, the board of the New York Stock Exchange sent their Vice President, Richard Whitney, onto the floor to buy blocks of well-known companies.

This strategy had stopped the stock market Panic of 1907, and they hoped it would work again in 1929.

and it did… for a little while.

But within a few weeks the markets would suffer a devastating rout, on what became known as 'Black Tuesday' the greatest one day stock market crash in History.

The selling would continue on and off for more than two years,falling more than 80% when it finally reached the bottom in 1932.

The Chinese, who like to copy – (but with Chinese characteristics)

Seem to be taking a page from this playbook, but with a twist that makes it even riskier. As the Chinese property markets slowed in 2014, investors and speculators turned their attention from real estate to stocks. During that year the main China stock index, the Shanghai, moved up more than 150%.

For months the Chinese papers were full of stories of small-time investors making money from the 'Chinese economic miracle', Stories were everywhere about how China, now the world's number two economy would soon surpass the mighty USA. Many people, (due to urgings from the government) and to help China's new economic growth, took out loans to purchase shares.

The market continued to grow as more and more little people borrowed money to get in on the 'rising' market. Money moved from real estate into the stock market, pushing prices way beyond any sensible value and soaring prices had everyone wanting to get in to 'make money'... Despite the slowing economy, despite the failing Real Estate Values, and spurred on by lower and lower interest rates money poured in....

The Shanghai stock index was breaking records and it peaked in early June 2015 at 5,178, (a 7 year high) and then ...... fell dramatically over the following three weeks. By the beginning of July, the index was off almost 30% – (down around 3,500), losing over US$2.4 trillion.

These massive losses were softened a bit because the government had recently changed regulations to keep margin loans outstanding, even as share prices declined. Since investors haven’t been required to meet margin calls by putting up more collateral or selling their shares at a loss, the selling has been orderly so far.

![]()

Ready to put this into action?

Start your free journey today — no credit card required.

But they didn’t just stop there.

In addition to interest rate cuts and lowering reserve requirements, the government also recently pumped money directly into brokerage firms for the express purpose of making even more margin loans.

At the same time, just as with the stock exchange and Richard Whitney in the 1920s, China’s government tried to force prices higher by purchasing shares in large companies. After plummeting 30%, these efforts sent the Shanghai up 2.4%, initially but then it turned and continues it downward trend.

But the stock market in China is not like the market elsewhere. In China the market regulators impose a 10% upper and lower 'cut off' so as soon as a stock hits those perimeters it's suspended from trading for the day in an effort to 'control' the market.

Policy makers have already suspended initial public offerings, relaxed margin trading rules, cut transaction fees and directed state-run institutions to maintain or boost equity holdings. A group of 21 brokerages pooled at least 120 billion yuan (US$19.3 billion) for a market support fund.

Yet despite all this and a massive injection of Government cash into the market, plus the suspension of 45% of the smaller stocks from trading (to make the 'numbers' look better and preserve their value) the market continues to decline.

Clearly, the Government is desperate, as it needs to be seen to be in control of the economy. With slowing exports and falling construction, the Chinese have staked much of their future on domestic consumer spending.

If mom-and-pop investors carry margin debt for stocks that have plummeted in value, they won’t be able to buy more stuff and drive up the economy.

It can’t afford to see its emerging consumer class hit with huge loan losses. If they lose their equity value in their real estate and owe money on their margin loans, then untold numbers of mum and pop investors could be wiped out and that will make the Government look very bad.

Economically and politically it needs the markets to hold and go higher.

This might explain why the Chinese have taken their efforts to yet another level.

Not only has the government funneled even more money to brokerage firms to lend to investors so they can buy more stocks, but they have also loosened the rules on what type of assets investors can pledge as collateral. (Remember the government controls almost every aspect of the economy) So the Chinese people can now pledge their homes to cover the borrowed money, to make stock market investments.

This goes way beyond channelling money to brokerage firms to lend to investors. If those investors are now pledging their homes and using the money to buy or pay for stock, then any market losses could lead to the forced selling of shares followed by the liquidation of real estate holdings. Because now stocks are bound to another asset, Real Estate that is also in a bubble.

In other words, both the stock market & the real estate market could crash together!

If only the Government intervention stopped there. But no, the Chinese government has been buying up thousands of empty homes, by homes I mean hundreds of apartment blocks, supposedly to house the nation’s poorest households. The idea is that this will give the property market, and the hopefully the economy, a boost.

Will China Go Broke?

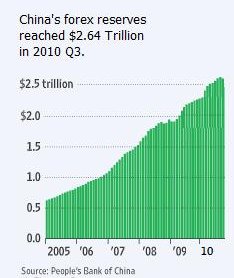

At last report, China held US$3.73 trillion in foreign currency so the country is well-capitalized, so a stock market crash and the selloff in real estate won’t send the nation into bankruptcy. Remember that in China the Government still owns all the land and it's 'leased' to the 'home owners' who may own their house but not the underlying land.

But it will hurt the people when those prices start tumbling but as the government also controls the media, the rumblings from the people will be muted.

Instead all the state run media is focused on the 'Greek Debt Crisis' and 'other issues' with very little negative coverage on their own stock market. Also the internet has become painfully slow as the government seeks to restrict (even further) internet access to the outside world.

.

But the pain will not just be in China

When the China feels the pain, all of its trading partners, Japan, South Korea, Australia and the USA will all share in the discomfort.

As China goes through the process of falling market values, and suppressing the 'real story', international investors, the very people China is trying to attract, should be thinking carefully before they invest anywhere in the Asian region.

A powerful reason to keep working on building your online business here at wealthy Affiliate.

Share this insight

This conversation is happening inside the community.

Join free to continue it.The Internet Changed. Now It Is Time to Build Differently.

If this article resonated, the next step is learning how to apply it. Inside Wealthy Affiliate, we break this down into practical steps you can use to build a real online business.

No credit card. Instant access.