Are You Planning On Outsourcing Your Content?

Are you planning on outsourcing your content?

This is how the Small Business Administration distinguished between employees vs. independent contractors and how it can impact our bottom line, as this affects how we withhold taxes and avoid costly legal consequences.

When we learn the differences we will be prepared.

When we outsource to an independent contractor they operates under a separate (their own) business name from our company and invoices for the work they completed. At times an legally an Independent contractors can sometimes qualify as an employees. Be sure to understand how that is possible. Do you really have a personal assistant or a virtual assistant?

If our contractor meet the legal definition of employee, we may need to pay back taxes and penalties, provide benefits, and reimburse for wages stipulated under the Fair Labor Standards Act.

However, as an independant contractors we pay our own overheads.

Join FREE & Launch Your Business!

Exclusive Bonus - Offer Ends at Midnight Today

00

Hours

:

00

Minutes

:

00

Seconds

2,000 AI Credits Worth $10 USD

Build a Logo + Website That Attracts Customers

400 Credits

Discover Hot Niches with AI Market Research

100 Credits

Create SEO Content That Ranks & Converts

800 Credits

Find Affiliate Offers Up to $500/Sale

10 Credits

Access a Community of 2.9M+ Members

Recent Comments

9

the people you want to hire are either independent content writers, bloggers, or virtual assistants

Excellent answer. However, make sure they have their credentials so you could issue a 1099!

That might be so, however, here on WA you own this business. So you operate two-fold. At WA you issue 1099 and on your night gig you get a W-2.

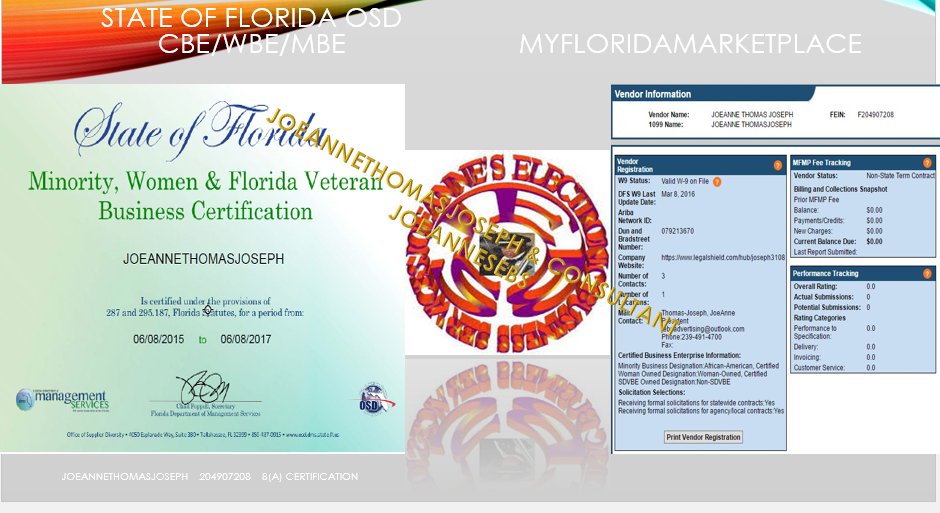

When you re-open that door make sure you issue them a 1099. Even for $5.00. I just learned the more 1099 I issue gives me credibility for if and when I need a certification that requires one as a business owner. Today it might be a project or a gig, but tomorrow, tomorrow and that tomorrow it is major company to compete with. Do not despise small beginnings.

See more comments

Join FREE & Launch Your Business!

Exclusive Bonus - Offer Ends at Midnight Today

00

Hours

:

00

Minutes

:

00

Seconds

2,000 AI Credits Worth $10 USD

Build a Logo + Website That Attracts Customers

400 Credits

Discover Hot Niches with AI Market Research

100 Credits

Create SEO Content That Ranks & Converts

800 Credits

Find Affiliate Offers Up to $500/Sale

10 Credits

Access a Community of 2.9M+ Members

It's always a good idea to understand what is happening in your business, thanks for pointing this out - it may also take a trip to your tax/HR/financial planner to get a good handle on these issues.