3 tips on how to organize your life

Published on April 4, 2016

Published on Wealthy Affiliate — a platform for building real online businesses with modern training and AI.

Have you ever sat and wondered whether you can still afford the training at WA? So much goes on in life and there are so many things which we think we need, when the truth is we can make life so much simpler, and save money at the same time!

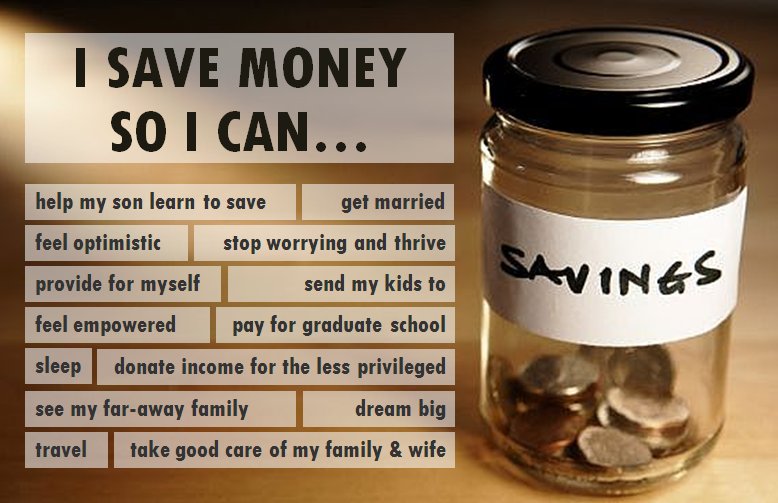

1: Make a list of your goals.

Write down what your financial goals are and why you need to save money. What means the most to you? Your career and moving forward here with the tools WA provide you with? Your family? Getting yourself out of debt now so you can enjoy the future?

Now concentrate on which are your top 3-5 goals. Almost immediately you can focus on the important things and start to train yourself to forget or ignore those things which may negatively impact on your goals.

2: Place everything negotiable on the table.

What is holding you back and dragging you down? Do you have a huge mortgage which constantly makes you fearful about the possibility of foreclosure? Do you have a gas-guzzling car which costs you a fortune in running costs?

Ready to put this into action?

Start your free journey today — no credit card required.

Can you look at downsizing both for the short term? Would that free up necessary finances to enable you to move forward with confidence?

There's no law which states that you must get rid of these choke-holds around your neck, but ask yourself how you would feel if you did. If you downsize now to free up much needed cash, then you can re-think later about where you want to live, when you've concentrated on your own business and made some money online.

3: If you have kids, make saving money fun!

Kids hate being told that you don't have the money to do something. What they do enjoy though, is being involved in family fun. Instead of 'treating' them to a fast food restaurant at the weekend, get together and make some home-made pizzas or chicken goujons, (whichever is their particular favorite.)

You will not only save a pile of money, but you will also know that there are no nasty additives or other hidden rubbish in the food you give them.

Get them to sort out their bedrooms and have a garage sale at the weekend. They will have fun making a few pennies; their bedrooms will be de-cluttered, (saving you some unnecessary work!) and they will learn the value of money if you allow them to save what they 'earned' towards their next 'must-have' item.

Hopefully you will soon start to save enough money to be able to comfortably afford your monthly investment here at WA as a Premium member. And look on it as an investment and not a cost - it's an investment into your future, your increased knowledge and education, and into your business.

After all, every business needs investment, whether it's a 'real' bricks and mortar one, or an online one. When something costs you, you get nothing in return. With WA you get bags in return!

Have a wonderful working week my WA friends.

Ciao for now, Jude.

Share this insight

This conversation is happening inside the community.

Join free to continue it.The Internet Changed. Now It Is Time to Build Differently.

If this article resonated, the next step is learning how to apply it. Inside Wealthy Affiliate, we break this down into practical steps you can use to build a real online business.

No credit card. Instant access.